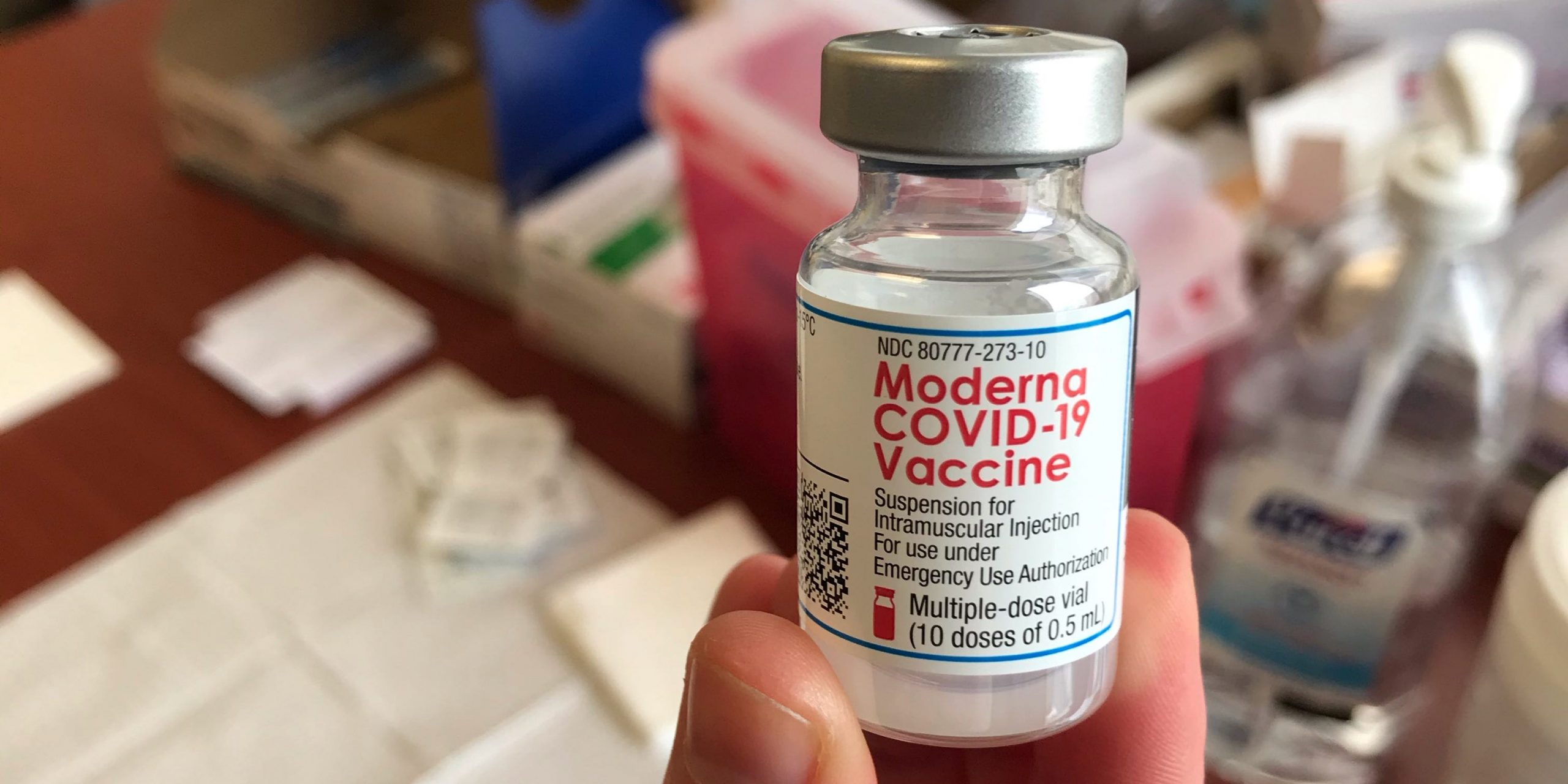

Madison Hall/Insider

- Moderna shares have dropped sharply since the Biden administration on Wednesday voiced support for waiving patent protections on COVID-19 vaccines.

- Morgan Stanley said it doesn't see the US's waiver support as having a material impact on Moderna's business.

- Moderna's management had indicated it wouldn't enforce its vaccine patent during the pandemic, says Morgan Stanley.

- See more stories on Insider's business page.

Moderna shares fell sharply for a second session Thursday after the US said on Wednesday it supports waiving intellectual property protections for COVID-19 vaccines. The stock has now declined as much as 23% since Monday's close after a 7% drop on Tuesday.

But Morgan Stanley said it doesn't see a waiver materially hurting the biotech company's business.

The Biden administration supports a waiver "in service of ending this pandemic," even as it "believes strongly in intellectual property protections," US Trade Representative Katherine Tai said in a statement Wednesday.

A waiver would allow other countries to make vaccines from Johnson & Johnson, Pfizer, and Moderna without fearing sanctions at the World Trade Organization.

While the US's waiver support generates "a negative headline, we believe the practical impact is limited," on Moderna's business, said Matthew Harrison, an equity analyst at Morgan Stanley, in a note published Thursday.

He said Moderna's management had previously indicated it wouldn't enforce its intellectual property patent during the pandemic. Meanwhile, the investment bank said it doesn't believe the WTO has any mechanism to force Moderna's management to teach other manufacturers how to make its vaccine, which suggests no change in the status quo.

"Finally, we believe any new manufacturing operation could take 6-9 months to scale, effectively limiting the impact of other manufacturers," wrote Harrison.

Shares of Pfizer were off by nearly 3% on Thursday and BioNTech was down by more than 2%.

"You have this political pressure to share patents with every pharmaceutical company. Then you have the other side of it, which is these pharmaceutical companies need to be motivated to always do research and development. Even though there was a pandemic and a humanitarian crisis, there is still a cost," Hilary Kramer, chief investment officer at Kramer Capital Research, told Insider.

"Whether it's Pfizer or Moderna or BioNTech, they have a responsibility to their shareholders and they also have a responsibility to continue to have a pipeline of products and to know [that R&D] is going to pay off," she said. "We need to watch that - that could have a greater impact on pharmaceutical stocks."